Help to Buy = Help to Profit

Shareholders and directors of corporate housebuilders and developers have gorged themselves on public subsidies – such as Help to Buy – that have profited them by more than £31 billion in the last ten years.

Finance specialists AJ Bell say this is due chiefly to price rises fuelled by Help to Buy, the government’s taxpayer-funded scheme, known in the real estate industry as ‘crack cocaine for developers’.

Those publicly subsidised house prices rises have led to £14bn being paid out in dividends to shareholders and millions in a ‘bonus bonanza’ for directors.

Housebuilders, says AJ Bell, look set to rake in more profits as the government – in its autumn 2021 budget – says it wants them to build more new houses.

Corporate developers are also relieved that a 4% Residential Property Developers Tax on housebuilders’ profits above £25 million ‘proved no worse than expected’. This will come into force on 1 April to help fund remediation work on fire-risk cladding on tower blocks exposed by the Grenfell Tower fire.

Debt

Corporate housebuilders Persimmon, Barratt, and Taylor Wimpey defend Help to Buy, which was introduced in 2013 to boost home-ownership by providing equity loans to buyers. They say 340,000 mainly ‘first-time’ buyers have taken on its equity loans.

Homes England expects to have lent up to £29bn of taxpayers money to property buyers under Help to Buy and other publicly subsidised schemes by 2023. Help to Buy made up 48% of new houses bought and sold between 2013 and 2018.

But Help to Buy equity loans have inflated demand and house prices, helping to triple corporate housebuilders and developer share prices – as well as increasing house buyers debt and making housing even less affordable to people on lower incomes in most need of new, genuinely affordable housing.

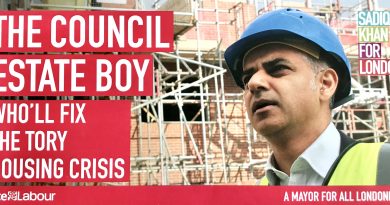

Council homes

London prices rose by 6.2% to £516,285 in 2021. House prices across the country rose 9.8% to an average of £285,113. House prices in London rose 1.9% in October 2021 alone, the highest monthly rise in England, according to government regional data.

And, now, nine years later, politicians on a House of Lords committee, in a report published in January 2022, say that this £29 billion of public subsidy – most of it for Help to Buy – could have been better spent on replenishing England’s diminishing stock of council homes.

Meanwhile, the stock of social or council housing has shrunk by almost 500,000 homes since 2000, according to housing charity Shelter.

© London Housing Review 2022

London Housing Review is copyright of © London Intelligence Limited ®